Re-examining Political Risk Assessments in Volatile Regions

- DOI

- 10.2991/jracr.k.191024.001How to use a DOI?

- Keywords

- Risk characterization; complex adaptive systems; Middle East and North Africa; risk assessment; risk analysis

- Abstract

Conventional country risk and political risk indexes, to formalize the process, have attempted to standardize and generalize assessment models for factors that are highly context specific. Hence, the value derived from traditional political risk indexes lack precision and are therefore less reliable. This paper re-examines political risk analysis and explains how understanding the topology and nature of political risk in emerging and developing markets is a crucial advancement in developing political risk analysis for the private sector and government agencies. Particular focus is given to develop political risk characterization as a risk analysis category. To bridge the conceptual gap between risk assessment and risk management, this paper proposes the concept of complex adaptive systems as the backdrop for emerging political risk scenarios.

- Copyright

- © 2019 The Authors. Published by Atlantis Press SARL.

- Open Access

- This is an open access article distributed under the CC BY-NC 4.0 license (http://creativecommons.org/licenses/by-nc/4.0/).

1. INTRODUCTION

Political risk assessments are increasingly becoming a business imperatives for corporations interested in expanding their business operations into developing and emerging markets, which usually exhibit political uncertainty. Political risk associated with market entry and subsequent business operations is a slowly evolving subcategory of risk analysis, and one that has not lent itself to strict mathematical modeling and probability assessments. To counter the subjective nature of non-scientific assessments, conventional political risk analysis and country risk indexes aimed at standardizing the process within formulas to account for political and social factors, mimicking thereby a standardized approach, applicable to all countries. The persisting shortcoming in this process is that political and social factors are necessarily context specific, i.e. interconnected and part of a complex adaptive system, thereby cannot be correctly evaluated as independent static variables. The resulting indexes hence remained at an artificial interval level spanning from low to high risk, and in most cases devout of valuable and relevant content for the private sector or government agencies.

Yet political risk, including cultural, social and economic factors are crucial component of evaluating a proposed investment environment, not to mention their utility for security and governance, all of which underscore the demand for developing reliable political risk analysis and processes. There are three justifications to re-evaluate political risk assessments:

- •

Providers of political risk insurance such as Overseas Private Investment Corporation (OPIC) and Zurich insure against a specific set of political risks: expropriation, political violence including wars and terrorism, and currency inconvertibility. Business entities can incur costs and losses at earlier stages, from different sources, before these extreme events manifest.

- •

Political and socio-economic variables have open continuous payoffs, because their statistical distribution does not have an upper bound. Hence, risk assessment and risk management cannot rely on probability distributions.1

- •

Corporations need to be proactive in volatile regions and fend against increasing losses related to political and geopolitical risks that are not governed by market and finance logic.

On the path of conceptually developing this crucial subcategory of risk analysis, this paper answers the following foundational question: How can we first conceptualize and integrate the nature of political risk in order to derive a better approach to risk characterization and improve assessment methodology? This paper takes on this question and suggests a path forward through the example of the Middle East and North Africa region.

2. UNDERSTANDING THE NATURE OF POLITICAL RISK

The intersection of politics and international business continues to be a focal point of interest to the business community and government agencies alike. While [1] contend that no universally accepted definition of what constitutes political risk exists [1], political risk is generally defined as the possibility of a business incurring loss or harm due to political changes in a country whether internal or external. While modes of entrance in international markets can range from exports, licensing, franchising, joint venture or wholly owned subsidiaries, political risk is a present factor in each entrance mode at different degrees. The literature identifies sources of political risk as either emanating from environmental factors, or from constrains on operations such as discriminatory taxes and foreign direct investment regulations [2]. Scholars have attempted to frame political risk through two distinct approaches and analysis types. First type focuses on the country’s attributes, processed as independent variables, such as evaluating political stability, corruption, and social cohesion and then estimating the probability of occurrence and impact ([3], p. 7). The second type evaluates and projects the behavior of government and economic functions through future oriented risk scenarios ([3], p. 9). Both approaches however attempt to frame political risk through simplifying and abbreviating a complex set of circumstances. Scholars have also realized that political risk reaches beyond the conventional risks of confiscation, asset recovery, expropriation and nationalization [4–7].

The literature is increasingly pointing to the complexity and interrelated nature of political risk factors as these factors exhibit a dynamic relation with the operational context. This realization however prompts us to question the utility of generalizable risk assessment models. Does corruption or ethnic tension in country A have a similar effect on business operations as corruption and ethnic tension in country B? If the answer is no, due to the contextual and interrelated nature of each risk factor, then generalized risk assessment models that codify the probability and impact of each so called “independent variables”, across diverse set of countries, are of minimum value to corporate and government decision makers. In order to arrive at a better understanding and appreciation of political risk, let us examine its nature first. To understand the nature of something is to understand its defining characteristics, which prompts us to localize our understanding of political risk, and proceed in the opposite direction of generalization.

Within the context of the Middle East and North Africa (MENA) region, political economic and social risk factors are products of their respective environments and are in constant dynamism, both shaping and being shaped by a complex adaptive system. The so called Arab Spring in 2011 for example had far reaching consequences within MENA countries and across the region. In this case, evaluating economic disparity, corruption and regime type would not be adequate to construct a comprehensive evaluation of the types of risks a company may face in country A with regards to social and political instability. This distinct interrelated and dynamic nature can be summarized through the main characteristics of political risk:

- •

Interrelated factors, in a nonlinear relation, that loose representation value when studied as independent variables.

- •

Risk factors exist in a complex system (region/country) in which the sum of individual components is not a reflection of the whole system.

- •

The context within which risk factors exist is an adaptive system that adjusts to disruption or intervention, which in turn changes the effects and impact of these risks.

- •

Emergent system properties and cascading effects cannot be predicted from precedent and historical data.

- •

Second and third order effects are a core characteristic.

To bring this understanding of the nature of political risk from the abstract to practical considerations, this paper will proceed with a discussion of regions as complex adaptive systems, and integrate assessment methods, in order to develop an integrated understanding of political risk characterization.

3. REGIONS AS COMPLEX ADAPTIVE SYSTEMS

Regions, such as Latin America, Western Europe or the MENA, have distinctive characteristics stemming from their history, geography, geopolitics, markets, governing structures, and deterministic historical development path of their respective polities. Observed similarities, and shared culture and norms within each region is a crucial representation of generational survival and evolution of norms, heuristics and historical memory. The background within which regulations, laws, trade, governing regimes, corruption, market competition, capital flows and other factors exist is part of the complex context of the region, state and market sector. The concept of Complex Adaptive Systems (CAS) is useful as it captures a fundamental characteristic that the behavior, or the politics of the system, cannot be accurately identified by the observed trends of its components without nesting the observations in context.

In this sense, understanding the limitations of mathematical modeling or quantitative simulations of uncertainties and risks in complex systems is key. A number of scholars have eluded to these limitations, and contended that mathematical models are less than useful in social sciences, this finding was mostly effectively proven by Gödel’s Incompleteness Phenomenon2 [8,9]. Researchers have also pointed out that normal probability distribution, most prominent in linear regression analysis among others, are not representative of the real world because these distributions underestimate the occurrence of risk categories of “known unknowns” and “unknown unknowns.”3 Fat tail probability distributions on the other hand account for such realities, yet researchers contend that forecasting is not possible in complex systems [10].

In order to identify risk factors and mitigate their possible impact, investing in acquiring region and country specific data and indigenous and local knowledge is a core component of an effective analysis. In addition to giving priority to context in MENA when conducting political risk analysis, local perceptions of what constitutes ethnic strife, economic equity, foreign intervention, and elite monopoly for example are part of acquiring a local understanding of the operational environment. The point is to give value to indigenous knowledge that has, over generations, not only survived but internalized and became the transmitters of constant feedback loops within CAS, where emergent properties allow the culture and polity to adapt and shape future states.

Middle East and North Africa region is also a strategic competitive space for global powers; the United States, China and Russia, as well as between regional powers such as Turkey, Iran, Israel and Saudi Arabia. The dynamics of this competition, which represents opportunities and constrains for each MENA country, affects and shapes the political risk environment in this complex system.

4. CONVENTIONAL RISK ASSESSMENT METHODS

Kaplan and Garrick [11–13] established the set definition of risk, as R:

A combination of quantitative and qualitative methods is also used in political risk assessment such as the cross-impact matrix method [15] as an example, in addition to scenarios and decision trees. In the cross-impact matrix method, after an initial set of possible events is compiled, and experts estimate the initial probability of each event in isolation, a conditional probability is estimated satisfying the consistency requirement as follows:

P(1) = probability that event 1 will occur;

P(2) = probability that event 2 will occur;

P(1/2) = probability of event 1 given the occurrence of event 2;

P(2c) = probability that event 2 will not occur; and

P(1/2c) = probability of event 1 given the nonoccurrence of event 2.

Other more straightforward methods rely on weighing the impact of possible risk factors across countries, and then aggregate and rank the risk score along the spectrum of high, medium to low risk. These simplistic approaches and reliance on current and historical data however limits the predictive capability of quantitative and qualitative models unless we are dealing with a stable environment, where the future state of the system is expected to resemble its past. This particular caveat is a crucial determinant in the urgency of re-evaluating political risk assessment in volatile regions such as MENA.

In addition and as mentioned in the introduction, political and socio-economic variables have open continuous payoffs, because their statistical distribution does not have an upper bound. Hence, risk assessment and risk management cannot rely on probability distribution and historical data solely. Monitoring and understanding historical data on certain factors however remains crucial and is part of the quantitative assessment, here is an example of such data points in Table 1.

| Political | Economic | Social | |

|---|---|---|---|

| Trends of civil unrest | Real GDP growth (%) | Religious and ethnic tensions | |

| Historical | Military in politics | Unemployment/employment trends by category | Poverty and marginalized communities by district |

| Presidential elections | |||

| Legislative and bureaucratic reliability | Foreign Debt as % of GDP and Debt Service as a % of XGS and types of loans | Youth mobilization and civil society | |

| Regional conflict spillovers, refugee populations | Inflation | Powers brokers within society religious and civil | |

| Monitoring | Elite monopolies by sector | Foreign Reserves and government budget deficits | Intelligence apparatus-community relations |

| Counter-terrorism policy | Oil and non-sectors | Media, social networks and press control | |

| Regional alliances | Regulations and implementation trends by sector | Islam-Christian and minority relations |

© iStrategic LLC.

Sample of data points for political risk assessment in MENA

Unlike relatively stable environments, MENA is prone to chronic instability that manifests in its security, economic, social and political environments, which have immediate and long term repercussion on international business, and strategic foreign government policy making. By examining the fragility index for 2019, the majority of MENA states are on the 80–120 scale on the fragility spectrum (0–120), where a score of 120 denotes a failed state [16]. MENA’s inherent regional characteristics are structural, hence, they shape and influence outcomes, yet these structural characteristics are less susceptible to change. For example the evolution of state-system and central governments in MENA after WWI, the underdevelopment of national identities, the oil resource dependent economies, and ethnic and religious heterogeneity are some of the structural constrains within which political, social and economic policy is exercised by regional governments. Given the aforementioned, how can we integrate the main defining characteristics of political risk in MENA so as to reflect the complex and dynamic reality of the operational environment in this region? The following section proposes a revised definition and positioning of Risk Characterization on the risk analysis continuum.

5. ADVANCING THE CONCEPT OF POLITICAL RISK CHARACTERIZATION

Risk analysis literature describes risk characterization as the bridge between risk assessment and risk management. Risk characterization is defined as integrating information from the risk assessment stage and synthesizing an overall conclusion of the main findings, including the context of those findings [17]. Most prominent in health, environmental, cyber, and infrastructure risk analysis, risk characterization is the decisive step prior to setting strategies to manage and mitigate these risks. Re-evaluating and redefining risk characterization to better fit the nature of political risk is a crucial step forward, as risk characterization precedes risk management and risk mitigation strategies, which in turn are the main objectives of international corporations and foreign governments interested in MENA.

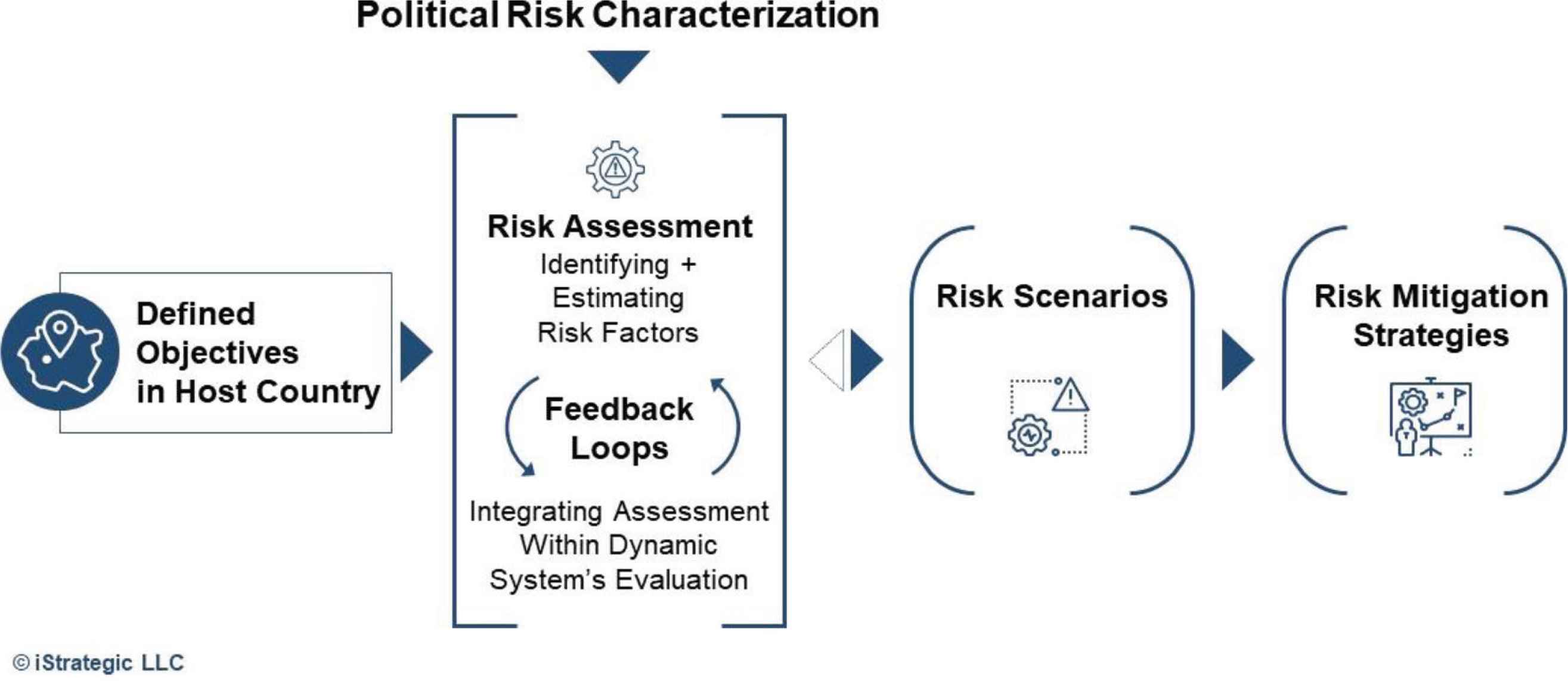

On the risk analysis continuum, political risk characterization has to exist within a vertical and along a horizontal dynamic. First, the vertical section comes after identifying non-market capabilities and risk tolerance of an organization, and then identifying its main objectives in the host country. Then, a vertical dynamic integrates two subcategories in constant adaptive mode, incorporating the analogy of feedback loops to denote how the context (complex system’s evaluation) shapes and adjusts risk assessments (data dominant), and how preliminary risk estimations have to go through the litmus test of a system’s evaluation. Only when risk assessments have made a few system’s evaluation rounds are they ripe and realistic enough to inform a set of risk scenarios. Even then, a horizontal dynamic positions risk scenarios for a possibility of a re-evaluation through the vertical risk characterization dynamic. The following illustrates how we may redefine Risk Characterization to reflect and integrate the complex nature of political risk within political risk analysis.

Unlike conventional approaches to political risk analysis, this illustration combines both analytic and quantitative methods while accounting for the context (complex system’s evaluation) as a vital source of feedback to adjust quantitative risk assessments. Only after a satisfactory completion of this vertical dynamic process can we proceed with risk characterization to inform risk scenario formations.

The following step after risk characterization is: risk scenarios, which ought to be perceived as an integral stage of political risk analysis (and not a substitute or alternative risk assessment method). Through risk scenario planning can the full potential of previous assessed risks be displayed through plausible narratives, accounting for second and third order effects. The following section gives an overview of how risk scenarios are framed.

6. MODELING POLITICAL RISK SCENARIOS

A number of scholars have explored how to integrate the reality of complex environments into scenario planning. Scenario Analysis (SA) has been defined as “..a description of a possible set of events that might reasonably take place. The main purpose of developing scenarios is to stimulate thinking about possible occurrences, assumptions and risks, and courses of action” [18]. Another definition describes SA as “..conjunctures about what might happen in the future” [19]. SA’s objectives may range from exploratory to advisory and primary support for decision-makers [20]. The stage of scenario planning is crucial as it generates an ordering mechanism for possible alternative future environments for the decision-maker.

Chermack [21] argued that the scenario planning stage is best modeled and understood through systems theory, in his study however he argues that the organization itself is conceptualized as a system and is assumed to self-organize through feedback networks. While this is a valuable contribution to SA literature, the operational environment in MENA requires at outward oriented systems’ approach as well. Scenario planning may be prompted by a diverse set of questions, and the most raised question in SA is “what can go wrong?.” The scenario organizing mechanism of Hierarchical Holographic Modeling (HHM) is useful to demonstrate one available framing tool to answer this question. HHM is regarded as “..a holistic philosophy/methodology aimed at capturing and representing the essence of the inherent diverse characteristics and attributes of a system” [22,23]. The term holographic refers to the multiview image of the system that include views of economic risk, social risk, political risk, …etc. The term hierarchical points to the importance of understanding risk factors at all levels of the system from the macro to the micro level, which in turn organizes scenarios into sets and subsets. An added development to SA was the Russian method of anticipatory failure determination where the question, instead of: what can go wrong?, becomes: what should happen for things to go wrong? Then both types of scenario planning questions were added in what we now call the theory of scenario structuring [24,25].

When a corporation is interested in understanding and investigating the political landscape in a potential host country in MENA, the importance of a comprehensive risk evaluation becomes crucial. Referring to the risk analysis model presented in this paper, in volatile regions, data analysis is not sufficient by itself, hence the vertical risk assessment dynamic has to be integrated with a context/system’s evaluation in order to arrive at comprehensive political risk characterization. The analogy of feedback loops within this vertical dynamic illustrates how quantitative risk assessments have to be nested and checked against the context where these risk factors have the potential to cause harm or create opportunities. Only then can a scenario analysis, that answers both questions of: what can go wrong? And what should happen for things to go wrong? Become a sufficient representation of possible alternative future scenarios for the decision-maker, ranked in a hierarchy of likely occurrence (see Figure 1).

Political risk analysis model.

7. CONCLUSION

In volatile regions like MENA, political risk analysis becomes an imperative for corporations, NGOs and foreign governments. Yet simple, standardized, one-dimensional approaches to political risk assessment are not only insufficient but downright harmful to the objective of sustaining and expanding business operations. This paper aimed at contributing to the development of political risk analysis by re-evaluating the concept of Risk Characterization as the gateway to integrate predominantly quantitative risk assessment methods with a complex system’s evaluation. Understanding regions and states as complex systems necessitates grounding data in indigenous knowledge and intelligence. The main objective of improving political risk analysis is to equip the corporate leadership and government policy makers with political risk management and risk mitigation strategies. Understanding and anticipating disruption by proactively monitoring warning signs is an essential operations mode in volatile regions. Developing professional corporate adaptive and proactive capabilities tailored for the political environment in a host MENA country is a competitive advantage in a region ripe with opportunities.

CONFLICTS OF INTEREST

The author declare they have no conflicts of interest.

Footnotes

Continues payoffs exist within an interval, not a finite set such as X: Q → [a, ∞) v (−∞, b] v (−∞, ∞) see Nassim Nicholas Taleb in Fooled by Randomness and On the Statistical Differences between Binary Forecasts and Real World Payoffs.

Gödel’s Incompleteness Theorem states that “all consistent axiomatic formulations of number theory include undecidable propositions.”

Known unknowns and unknown unknowns were two terms revived by Defense Secretary Donald Rumsfeld in February 2002 in a briefing to the US Department of Defense.

REFERENCES

Cite this article

TY - JOUR AU - Ghaidaa Hetou PY - 2019 DA - 2019/10/31 TI - Re-examining Political Risk Assessments in Volatile Regions JO - Journal of Risk Analysis and Crisis Response SP - 123 EP - 127 VL - 9 IS - 3 SN - 2210-8505 UR - https://doi.org/10.2991/jracr.k.191024.001 DO - 10.2991/jracr.k.191024.001 ID - Hetou2019 ER -