Trade facilitation and trade participation: Are sub-Saharan African firms different?☆

- DOI

- 10.1016/j.joat.2017.05.002How to use a DOI?

- Keywords

- F13; F15; O24

- Abstract

Sub-Saharan Africa is the region where firms face the greatest hurdles when it comes to cross-border trading. This paper examines how these firms, relative to their counterparts in the developing world, would respond to changes in the trade environment as a result of trade facilitation reforms. Using data from World Bank’s Enterprise Surveys, the paper suggests that improving customs clearance, government regulations, trade finance, and energy and telecommunication infrastructure contributes to increasing the probability of firms’ entry into exporting and importing, as well as to the extent of their trade. The results also indicate that African firms tend to respond more to a changing environment, owing to the greater constraints that they face. Exports tend to be more responsive than imports, suggesting a favorable short-term adjustment of the balance of payments. There is a sizable distributive effect, as larger and smaller firms gain differently depending on which reform and which direction of trade one considers. These results could help better understand how to harness the trade potential of sub-Saharan African firms, and they should constitute a welcome addition to the body of knowledge at a time when there is an uncertainty about the priority issues for multilateral agreements in the area of trade.

- Copyright

- © 2017 Afreximbank. Production and hosting by Elsevier B.V. All rights reserved.

- Open Access

- This is an open access article under the CC BY-NC license (http://creativecommons.org/licences/by-nc/4.0/).

1. Introduction

Firms in sub-Saharan Africa (SSA) face far greater hurdles than any of their counterparts in the rest of the developing world when it comes to international trade. In effect, it takes the average SSA firm 110.3 h for “border compliance” (handling, clearance, and inspections) and 98.0 h for “documentary compliance” to “export a shipment of 15 metric tons of the economy’s top non-extractive export product.”1 These figures are respectively 97.8 and 45.4% higher than the corresponding times it takes a typical firm elsewhere to export. Money-wise, border and documentary compliance costs respectively US$ 552.6 and US$ 245.8, which are 45.1 and 23.1% larger than similar costs faced by a typical developing country firm. The figures tend to be much higher on the import side: it takes more time (between 125.1 and 165.3 h) and it costs more (between US$ 360.2 and US$ 661.1) to import a “shipment (that) consists of 15 metric tons of containerized auto parts for all economies”. They amount to between 1.43 and 2.36 times larger than the costs in the rest of the developing world.

All of these are indicative of the low quality of the trade processes, the large magnitude of the associated costs, and consequently, the low trade performance of firms in the sub-continent as opposed to the outside world. They also tell about the renewed focus on trade facilitation, the first multilateral trade agreement to be successfully concluded since the advent of the World Trade Organization more than two decades ago.

Trade facilitation that aims to “ease the flows of goods across borders” refers generally to the “simplification and harmonization of international trade procedures”, the latter comprising the “activities, practices and formalities involved in collecting, presenting, communicating, and processing data required for the movement of goods in international trade.”2 To the extent that trade facilitation reforms are able to reduce trade costs, they have the potential to generate significant gains through greater trade participation and trade volumes of firms, as well as an increase in national income. In effect, it has been estimated that a reduction in trade transaction costs by just 1% as a result of trade facilitation would generate welfare gains that amount to US$ 40 billion, of which two-thirds accrue to developing countries (OECD, 2009). The larger gains to developing countries seem to be associated with the greater scope for improvement to the trade environment and the existence of some form of diminishing returns in investments in soft and hard infrastructure that will facilitate trade. Granted that sub-Saharan Africa lags behind the rest of the developing world as far as the quality of the trade environment is concerned, one could hypothesize that firms in the sub-continent stand to reap greater benefits from trade facilitation reforms.

The literature has produced a significant amount of both theoretical and empirical evidence that suggests that firms are poised to gain significantly. The resulting reduction in trade costs has been shown to increase the likelihood that non-exporting firms start to export. It also contributes to increase the productivity of individual exporting firms to the extent that there is a “learning-by-exporting” effect, as well as the productivity of the whole industry through a rationalization mechanism that forces less efficient firms to exit (see for instance Melitz and Redding, 2014; Bernard et al., 2006, 2003).

On the empirical side, trade facilitation indeed increases the probability that firms participate in international trade either as importers or exporters, and to the extent that they do, they tend to trade more intensely as a result of falling trade costs (see for instance Hoekman and Shepherd, 2015). Trade facilitation also contributes to (i) increase the survival rate of exporting firms in international markets (World Bank, 2012), (ii) improve trade diversification along the product lines, and consequently reduce vulnerability to foreign shocks (Dennis and Shepherd, 2011), (iii) raise the competitiveness of the whole economy (Spence and Karingi, 2011), and (iv) reduce the incidence of informal cross-border trading (Lesser and Moise-Leeman, 2009), among many other benefits.

This research intends to add to the ongoing research on how reducing trade costs though trade facilitation initiatives would affect the trade behavior of firms. It brings some improvement over and expansion of some key papers that particularly focus on the SSA context. One of these contributions is Hoekman and Shepherd (2015) who analyzed the distributional impacts of trade facilitation reforms, and drew some implications for African firms. Unlike the authors, we consider a broader range of trade facilitation indicators that go beyond customs efficiency (i.e., the time it takes to trade) to encompass additional measures, such as: the quality of the telecommunication infrastructure proxied by the usage of websites or e-mails, which could provide foreign business opportunities; access to credit that reveals the ease with which firms can recourse to trade finance; the state of the energy infrastructure, captured by the incidence of electric power outages, and that tells about the possibility for firms to increase their output and, consequently, their supply to foreign markets (exports) as well as their demand for foreign inputs (imports); and the efficiency of the overall government regulations captured by the time spent by the senior management dealing with them.

Furthermore, pulling all firms from all over the world together in the same analytical framework may not tell much about the relative complexity of the trading environment in the African context and how it specifically translates into the relationship between trade facilitation and trade performance. Singling out African firms, as opposed to burying them in the pool of developing countries’ firms, may be a better approach to investigating “why don’t African manufacturers export more?” (Clarke, 2005), or whether “Africa is different” (Iwanow and Kirkpatrick, 2009).

Moreover, looking into how trade facilitation initiatives affect the intensity with which firms are trading may not tell us why firms decide to enter exporting or importing in the first place. With the belief that the likelihood to start trading with the outside world and the amount being traded are governed by two different generating processes, owing in part to the different nature of the trade costs involved (essentially fixed or sunk costs for market entry and variable costs for continuing trade), it is equally interesting to look at both the likelihood to trade and trade intensity. The combination of the latter would provide a broader and more accurate picture of trade performance.

A careful analysis of how a broader range of trade facilitation measures impact both the likelihood and the propensity to export and import would help in the prioritization among various reforms that tend to be very costly to implement, especially in the context of limited government budgets in the sub-continent.3 It will therefore contribute to the design of targeted and effective public policies that would unlock the trade potential of SSA firms. This could in the end lead to a better exploitation of specialization opportunities in international markets and a greater integration into global value chains.

Using the World Bank’s Enterprise Survey data of close to 50,000 firms from 80 developing economies (of which nearly 10,000 firms are from 20 SSA economies) and spanning from 2010 to 2016, the paper develops a model that accounts for the self-selection of firms into foreign markets either as exporters or importers. The first part (Probit) helps identify the factors that affect firms’ decision to enter exporting or importing, while the second part deals with the determinants of trade intensity for trading firms.

The results suggest that when it comes to firms’ trade behavior, all components of trade facilitation tend to matter. In effect, a reduction in the time it takes to clear imported or exported goods or in the management time spent dealing with government regulations, a greater use of telecommunication tools (websites or e-mails), a reduction in the incidence of power outages, and an improvement in the functioning of the credit market all contribute to significantly increase firms’ likelihood and intensity to both export and import. The results tend to be more pronounced for firms in SSA than their counterparts in the developing world, in part because of the more adverse effect of the current trade environment. In addition, exports appear to be more responsive to imports, suggesting no deterioration in the balance of trade as a result of reducing trade bottlenecks. Moreover, the results suggest a sizable distributional effect along firms’ size, depending on the trade facilitation indicators and the trade direction. In particular, smaller firms tend to benefit the most from improving regulations and customs in both export and import markets; access to finance and the quality of the energy infrastructure generate greater gains for smaller firms in export markets and for larger firms on the import front; and a reduction in power outages benefits equally both smaller and larger firms in exporting markets, but larger firms tend to gain the most in the importing markets.

The rest of the paper unfolds as follows. The next section briefly discusses the literature. Section 3 details the methodology. Section 4 presents the data. Section 5 discusses the results. Section 6 offers some concluding remarks.

2. Review of the literature

Trade facilitation, in its narrowest sense, is about reducing the costs of moving goods across borders. More broadly, it is customary to distinguish between the “hard” components that relate to tangible infrastructure such as roads, highways, ports, telecommunications, on the one hand, and the “soft” components that refer to intangible aspects of the likes of transparency, customs management, business environment, and other institutional aspects, on the other hand (Portugal-Perez and Wilson, 2010).

A large body of both theoretical and empirical literature has provided a significant amount of evidence that clearly shows that facilitating trade would greatly benefit firms. For instance, various insights from a new class of “heterogeneous-firm” models of international trade have suggested that, by reducing both direct trade costs and trade transaction costs, trade facilitation increases the likelihood that non-exporting firms start to export as well as the profitability and trade volume of existing exporting firms. To the extent that there is a learning-by-exporting mechanism, on one hand, and that the rationalization effect by which less efficient firms exit the markets fully takes place, on the other hand, trade raises productivity at both firm and industry levels, and it is associated with large welfare gains (see, for instance, Melitz and Redding, 2014; Bernard et al., 2006, 2003; Melitz, 2002; Yeaple, 2002; De Loeckera, 2013).

The empirical literature tends to corroborate these theoretical findings, particularly those that focus on SSA firms. For instance, Hoekman and Shepherd (2015) showed that trade facilitation, in terms of reducing the time it takes to clear customs, has the potential to improve African firms’ participation in global value chains through increased direct exports and imports. The authors also suggested that these trade gains accrued to small and large firms alike, and exports tend to increase faster than imports as a result of reduced trade time, suggesting a positive short-term adjustment of the balance of payments.

Hoekstra (2013) showed that trade facilitation can increase African firms’ likelihood to participate in international markets, and that lowering trade barriers would lead to an increased propensity to export. The results tend however to vary across a broad range of trade facilitation measures, with telecommunication, transport and energy infrastructure being associated with greater benefits. Iwanow and Kirkpatrick (2009) suggested that export performance of African manufacturing firms was impeded by poor infrastructure and unfriendly regulations. Clarke (2005) showed that restrictive trade regulation, as well as poor customs administration were key explanations of why African firms have been unable to gain a strong presence in the global manufacturing market and why, consequently, the region has remained highly dependent upon a narrow range of primary commodities for their export earnings, which in turn has left them fairly vulnerable to market shocks.

Trade facilitation has also been found to generate additional trade benefits. By reducing trade costs, it promotes trade diversification, thereby reducing the vulnerability to foreign shocks. Dennis and Shepherd (2011) suggested that a 10% decrease in trade costs, such as those related to document preparation, inland transport, customs, and port charges would lead to a 3 to 4% increase in the number of products being exported. This turned out to be greater than the impact of a reduction in market entry costs, with a similar cut resulting in an increase of only 1% in the range of exported products.

Furthermore, trade facilitation contributes to increase the survival of existing exporting firms, as shown by Fugazza and Molina (2011). They suggested that high export costs systematically increased the probability of export failure. World Bank (2012) also suggested that the short survival of African firms in export markets was largely explained by relatively high trade costs in the continent.

In addition, facilitating trade has been found to reduce the likelihood that firms engage in informal/ illegal cross-border trading. Lesser and Moise-Leeman (2009) showed that measures that contribute to reduce transaction costs associated with mandatory trade-related procedures, along with mechanisms that lessen the complexity of trade-related regulations and requirements had the potential to encourage African traders to switch from informal to formal trading.

Overall, the ongoing research on how trade facilitation would impact firms’ trade behavior has indeed produced a significant amount of evidence that would convince of the necessity to undertake the associated reforms in order to unlock the international trade potential of firms. But most of the papers tend to tackle a few issues at a time, thereby reducing the scope of the analysis and the implications of the research outcomes for public policy. For instance, Hoekman and Shepherd (2015) looked at only one component of trade facilitation; that is, border efficiency, or the time to trade. From a policy standpoint, this may not tell much about the overall complexity of the multifaceted trade environment, to the extent that the single indicator may not reveal the burdensome nature of the whole environment. The same goes for papers that have looked at particular sectors, such as manufacturing, or just one side of trade, such as exports (Hoekstra, 2013; Iwanow and Kirkpatrick, 2009; Clarke, 2005). By analyzing how a broader range of trade facilitation indicators affect both the likelihood and the propensity to export and import across various industries, this research could significantly add to the existing body of knowledge, and offer strong policy implications as far as prioritizing among the costly trade reforms is concerned in the SSA context of relatively tight and overstretched government budgets.

3. Methodology

It is a well-established stylized fact that relatively few firms are engaged in cross-border trading (see Greenaway and Kneller, 2007; Eaton et al., 2004; and Tybout, 2003, for some reviews of the literature). SSA firms are no different, and to the extent that trade costs are higher in the sub-continent, it is expected that far fewer firms participate in international markets, and most of them either sell at or purchase only from home. A typical firm-level dataset on trade is therefore a mixture of zero and positive trade (trading and non-trading firms). The following benchmark model is to be considered:

As the explained variable Yj is zero-inflated, regular OLS (or GLS) would yield biased and inconsistent estimates. An alternative approach should be able to tell first why some firms trade and other do not (zero and non-zero trade), and then, for existing trading firms, what drives the extent to which they trade (positive trade). A two-sage selection model is therefore needed as it explicitly distinguishes between the two data-generating processes.

We differentiate the variables included in the vector of controls Xj by adding two more in the first-stage Probit model only: the share of trading firms and the share of foreign-owned firms in the industry. The use of these two exclusion restrictions in the structural equation is a better approach when it comes to model identification, as using the same vector in both the structural and the linear equations generally leads to imprecise estimates (incorrect standard errors) due to the collinearity between the Mill’s ratio and the explanatory variables (Wooldridge, 2002). The addition of these variables follows the literature that puts forth the idea of export spillovers: a given firm is more likely to start trading with the outside world when its direct competitors are exporters; this is also the case when the sector is open to foreign direct investments from which indigenous firms can learn or with which they can establish vertical or horizontal commercial linkages (see for instance Koenig et al., 2010; Kee, 2015; and Aitken et al., 1997).

One potential issue when dealing with various components of the trade environment is their multicollinearity, as the quality of the environment as a whole tends to translate into all of its individual component elements. In a country with a friendly trade environment, all of the energy, financial and telecommunication infrastructure and the regulatory framework tend to be of high quality, while in a country with an adverse environment, all of the component elements may be of low quality. However, to the extent that the data are able to capture the heterogeneity of national efforts that have not succeeded in improving simultaneously all aspects of the trade environment, such a multi-correlation may not be an important issue. This is suggested in Table A1 in the annexes that shows relatively low pair-wise correlation coefficients among the trade facilitation indicators. The highest is for customs efficiency indicators on the import side and on the export side, with a figure of 0.69. They will luckily enter the regression equations separately, one for imports, the other for exports. The second highest coefficient is 0.44 between telecommunication and finance, which in the end may not be that harmful to the whole quality of the regression results.

Furthermore, although the surveys tend to be similar in their design, there are some noticeable differences that could potentially affect the results, if not properly accounted for. The country surveys are conducted in different periods and values are expressed in local currencies. Instead of accounting separately for these cross-country differences without bringing additional issues (for instance by converting values into a single denomination), we simply add country dummies that will also account for additional differences which may not be observable. Furthermore, it is customary to control for industry fixed effects, but this may cause some redundancy as we have already included two industry-based variables (share of trading firms and foreign-owned firms).4

The two-stage Heckman selection model will be estimated by considering separately imports and exports. The results will tell about the extent of the short term adjustment of the balance of payments. We will first consider the whole sample so as to reveal broad trends in the developing world, and then only firms from SSA to see whether the latter tend to respond differently to any change in their trading environment. We will include interactions between trade facilitation variables and firm size to capture any distributional effects; that is, whether larger firms will benefit more than smaller firms from any given trade facilitation reform.

4. Data and descriptive analysis

Cross-sectional, firm-level data from the World Bank’s Enterprise Surveys are used, with a total of close to 50,000 firms across 80 developing countries (20 from SSA). The surveys are conducted at different points in time, between 2010 and 2016.5

Table 1 offers some descriptive statistics of the data. Consistent with the literature, relatively fewer firms are actually engaged in international trade. In effect, only 17% do export directly (23.5% for both direct and indirect exports). This is in the broad range of figures in most developed countries (such as 17.4 in France, and 14.6% in the US - see Eaton et al., 2004). On the import side, the figure is relatively higher, but firms that actually import material inputs and supplies are still in the minority, with only 29.1%.

| All countries | SSA countries | |||||

|---|---|---|---|---|---|---|

| Obs. | Mean | Std. dev. | Obs. | Mean | Std. dev. | |

| Exporting firms, direct (%) | 47,787 | 16.9 | 0.4 | 9671 | 11.2 | 0.3 |

| Exporting firms, indirect (%) | 47,787 | 9.5 | 0.3 | 9671 | 10.9 | 0.3 |

| Exporting firms, all (%) | 47,480 | 23.5 | 0.4 | 9671 | 16.7 | 0.4 |

| Export share (% of sales) | 10,748 | 46.38 | 34.8 | 1600 | 49.05 | 33.3 |

| Importing firms, direct (%) | 47,408 | 29.1 | 0.5 | 9671 | 23.1 | 0.4 |

| Import share (% input costs) | 13,796 | 52.28 | 31.6 | 2231 | 55.14 | 31.5 |

| Regulation (%) | 47,760 | 9.54 | 18.2 | 9644 | 7.58 | 17.1 |

| Energy (count) | 41,606 | 143.55 | 58.8 | 8308 | 223.95 | 94.2 |

| Telecoms (%) | 47,787 | 74.6 | 0.4 | 9671 | 54.5 | 0.5 |

| Finance (%) | 47,787 | 34.5 | 0.5 | 9671 | 18.3 | 0.4 |

| Customs clearance: exports | 7752 | 6.10 | 15.2 | 985 | 5.40 | 12.0 |

| Customs clearance: imports | 7800 | 11.35 | 17.7 | 1174 | 15.37 | 21.5 |

Descriptive statistics.

Source: Author’s calculations from the World Bank’s Entreprise Surveys data.

In addition, firms in developing countries that enter foreign markets tend to trade relatively intensely, and more so than their counterparts in developed economies. On average, close to half of the total output of exporting firms is sold abroad, against 21.6% in France and only 10.3% in the US (see again Eaton et al., 2004). Figures for imports are again higher, with 52.3% of inputs being of foreign origins. The greater incidence of imports in developing countries could be indicative of a weakly vertically-integrated domestic production base that would otherwise have been a great provider of input materials to domestic firms.

African firms tend to be less likely to participate in foreign markets than firms in the rest of the developing world, either as exporters (only 11.2% do export directly, and 16.7% for both direct and indirect exports), or as importers (23.1%). This could be the result of a low production capacity that provides relatively little room for foreign sales and demand for foreign inputs. Alternatively, it could be suggestive of a less friendly trade environment that would make entry costs to foreign markets relatively higher in SSA. Nevertheless, once they succeed into entering foreign markets, SSA firms tend to trade more intensively than firms from other developing countries (about 3-percentage point higher than the average). On the import side, the reason could be the greater need for foreign inputs as a result of lower domestic production of input materials. On the export side, a weak domestic demand as a result of lower national income would translate into larger differential of opportunities between domestic and foreign markets and higher incentives to sell abroad.

The data also provide a first glimpse at the unfriendliness of the trade environment that face SSA firms compared to their foreign counterparts. It takes 4 more days to clear imported goods in SSA. Less than one-fifth of firms have access to credit or trade financing, which is about half the average in the developing world. While a little over half of SSA firms have websites or use e-mails, close to three-quarters of typical firms in developing countries do. Energy infrastructure is of lower quality in SSA, as indicated by a greater incidence of electric power outages: 144 times per year, which amounts to at least 156% higher than elsewhere in the world.

What appears to be positive aspects of the trade environment in SSA as opposed to the rest of the developing world is the time spent dealing with government regulations (a 2 percentage-point differential) and the customs clearance time for exports (close to 2 days). Whether such differences are significant enough to tell how firms in SSA may respond differently to various trade facilitation measures would require rigorous analyses.

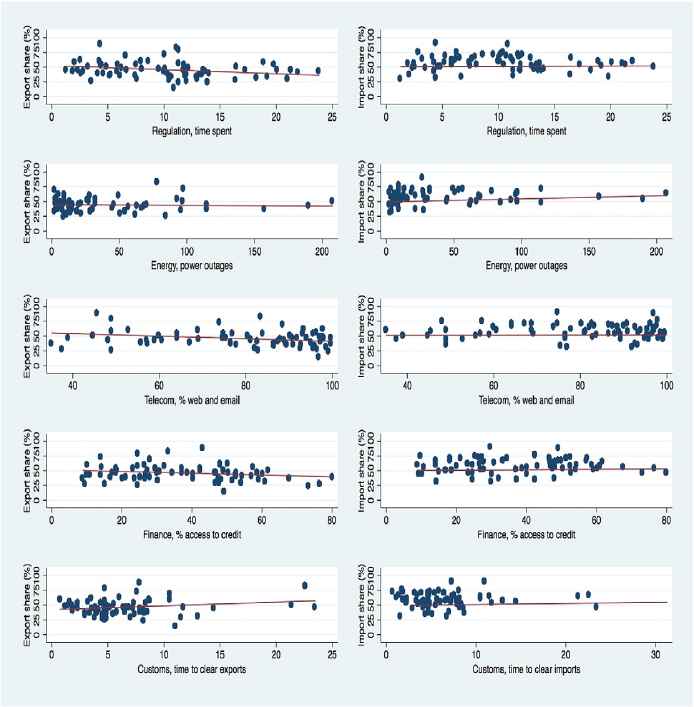

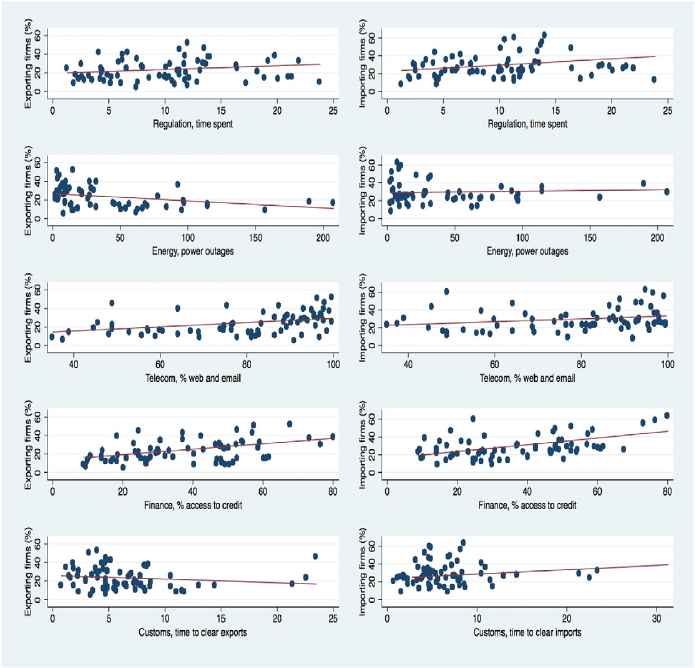

Figs. 1 and 2 in the annexes offer a first step toward understanding how improving trade environment would affect the probability of entry into foreign markets and the trade intensity. Overall, the panels tend to suggest positive outcomes, although in some cases the results may be less conclusive, as related to the slope of the fitted line or the sign. A more formal analysis would put these relationships into a multivariate regression framework that controls for additional factors and corrects for potential biases.

Trade facilitation measures and trade intensities.

Source: Author, from World Bank’s Entreprise Surveys. Export shares represent a percentage of sales sold abroad, and import shares a percentage of total input costs (except labor costs).

Trade facilitation measures and trade status. Source: Author, from World Bank’s Entreprise Surveys.

5. Results

Table 2 shows the estimation results from an OLS and a Heckman selection models for all countries and for SSA countries, first for exports and then for imports. The OLS estimates and the Heckman selection model estimates tend to be very different, suggesting the presence of a selection bias. This is confirmed by the statistical significance of the Mills’ ratio and the coefficients on the exclusion restriction variables in the first-stage Probit model (shown in Table A2 in the annexes).

| Exports | Imports | |||||

|---|---|---|---|---|---|---|

| OLS: all | Heckit: all | Heckit: SSA | OLS: all | Heckit: All | Heckit: SSA | |

| Regulation | − 0.1735*** (0.01) | − 0.1938*** (0.01) | − 0.3532*** (0.08) | − 0.1601*** (0.01) | − 0.1933*** (0.01) | − 0.6419*** (0.14) |

| Energy | − 0.8347*** (0.01) | − 1.5076*** (0.01) | − 3.3092*** (0.01) | 0.02703** (0.01) | − 0.0127 (0.01) | − 1.2441*** (0.01) |

| Telecoms | 4.1914*** (0.27) | 4.4574*** (0.30) | 13.9393*** (2.43) | 0.2328* (0.32) | 1.6643*** (0.64) | 3.3616* (3.55) |

| Finance | 7.8258*** (0.25) | 6.2655*** (0.45) | 5.0982** (3.08) | 6.5885*** (0.26) | 2.2974* (1.53) | 6.3253** (3.25) |

| Customs | − 0.1846*** (0.01) | − 0.2342*** (0.02) | − 0.4957*** (0.10) | − 0.1218*** (0.01) | − 0.0633*** (0.02) | − 0.2937*** (0.07) |

| Size | 0.0001* (0.00) | 0.0002 (0.00) | − 0.0006 (0.01) | − 0.0002** (0.00) | − 0.0001** (0.00) | 0.0012* (0.00) |

| Age | 0.0070*** (0.00) | 0.001 (0.00) | − 0.0069* (0.00) | 0.0196*** (0.00) | 0.0014 (0.00) | 0.0195* (0.00) |

| Informal | − 0.7381*** (0.24) | − 0.9446*** (0.27) | − 0.2912 (1.10) | − 0.6917*** (0.25) | − 1.1206*** (0.35) | − 2.4287* (2.17) |

| Foreign equity | 1.1734*** (0.08) | 0.2786* (0.34) | 3.7770** (1.51) | 1.1630*** (0.09) | 0.4712* (0.58) | 1.6254* (1.41) |

| Manager’s experience | 0.0218*** (0.00) | 0.0114*** (0.00) | 0.0263* (0.02) | 0.0111*** (0.00) | 0.0299** (0.01) | 0.0852* (0.06) |

| Labor productivity | 0.0000*** (0.00) | 0.0000*** (0.00) | 0.0001*** (0.00) | 0.0009*** (0.00) | 0.0000*** (0.00) | 0.0001** (0.00) |

| ISO | 1.4256*** (0.06) | − 0.1398 (0.36) | 2.0322* (1.30) | 1.6440*** (0.07) | 0.1706 (0.52) | 1.3456* (1.44) |

| Capital city | − 0.4840*** (0.07) | − 0.3747*** (0.08) | 0.3405* (0.42) | − 0.1692** (0.07) | − 0.5001*** (0.15) | 1.9606** (1.13) |

| Intercept | 16.2588*** (0.20) | 21.7757*** (1.28) | 41.1012*** (7.71) | 11.2543*** (0.25) | 21.5052*** (3.55) | 24.4932** (11.18) |

| N | 38,890 | 38,890 | 7432 | 37,168 | 37,168 | 7072 |

| F | 297.36 | 262.61 | ||||

| R2 | 0.37 | 0.35 | ||||

| Mills(lambda) | − 3.0983*** | − 10.0825*** | − 5.5983*** | − 11.2974** | ||

| Wald Chi2 | 2324.2*** | 176.6*** | 867.7*** | 115.6*** | ||

Notes: The dependent variable is the logarithm of firms’ exports or imports. Each regression includes country dummies. Values between parentheses are the standard errors, and significance at 1, 5, and 10% are indicated by ***, **, and *.

Estimation results.

Overall, trade facilitation variables affect significantly both exports and imports in a way that one would predict. This is the case for the whole sample and when only SSA firms are considered. In effect, a reduction in the time spent by senior management dealing with public regulations, a decrease in the frequency of power outages, a greater usage of telecommunication tools, an improved access to credit and loans, and a reduction in the customs clearance time all contribute to increase the intensity with which firms trade with the outside, either as exporters or as importers. These results add to general literature that shows that improving the trade environment, by reducing the trade transaction costs, is beneficial to trade performance of firms, as they tend to trade a greater amount of inputs and output.

The results also indicate that exports tend to respond more than imports to a change in trade facilitation indicators, except for regulation and finance in SSA. The differential is as high as 4 percentage points (finance) for the whole sample and 10.6 percentage points (telecommunication) for SSA firms. This greater response of exports is in line with Hoekman and Shepherd (2015), and is suggestive of a positive trade balance adjustment to trade facilitation reforms. It is also an indication that, in the short run, firms are more able to adjust output and export volumes than input and import volumes because the former may not involve a significant change in the production techniques (especially for firms operating below full capacity). Furthermore, while an increase in exports (foreign sales) directly translates into greater firms’ revenue, a change in imports or purchase of foreign inputs raises production costs, which may have an adverse effect on firms’ profit, at least in the short run.

When it comes to SSA versus the rest of the developing world, firms in the sub-continent tend to be more responsive to a changing trading environment. On both export and import sides, an improvement in any component of the trade environment is conducive to a greater increase in trade intensity of African firms (except for access to finance as related to exports, for which SSA firms tend to gain less). The gain differentials range from 0.3 (customs clearance) to 9.5 percentage points (telecommunications) for exports, and from 0.2 (customs clearance) to 4.0 percentage points (finance) on the import side. These relatively larger potentials for trade expansion of firms in SSA could be a result of the greatest hurdles firms face in the subcontinent; these impediments to trade provide a greater scope for trade reforms. The extent to which these reforms are characterized by some form of diminishing returns could also further rationalize why African firms would gain much more from reforming the trade environment.

The coefficient estimates on the controls suggest additional explanations of trade behavior of firms. In all developing countries, including SSA, formality is associated with a greater trade incidence, granted that informality may prevent firms from entering into and developing lasting foreign business partnerships. Furthermore, foreign-owned firms trade more intensely than their domestically-owned counterparts, as a result of their relatively greater knowledge of foreign markets, which in many instances are their countries of origin. So do firms with more experienced managers who tend to have a better understanding and reading of the industry dynamics and foreign market prospects. Moreover, increased productivity is associated with more imports and exports, as the corresponding demand for inputs and the possibility to sell abroad rise. As far as the geographical location is concerned, the capital cities in many developing countries, including SSA, offer better economic infrastructure, including trade facilities. They also tend to be directly connected to foreign markets, as most of them have been developed around ports. As a result, firms located in capital cities tend to trade more with the outside world. Finally, as a mark of reputation and quality, an internationally-recognized certificates contribute to help boost trade relations with foreign partners.

SSA firms depart from the rest of the developing world as far as the remaining characteristics are concerned. For instance, when it comes to size, larger firms tend to import more in SSA, while smaller firms do so in the developing world as a whole. Firms’ age appears to matter only for SSA firms, as older ones have a tendency to import more but to export less than their younger counterparts. To the extent that a relatively high entry cost in export markets is responsible for a very low survival rate of exporters in SSA (World Bank, 2012), one could expect, at any given point in time, to find older firms struggling to export greater volumes or on the brink of exiting the export markets. On the import side, foreign competition tends to be less harmful, and a longer reliance on foreign supplies could translate into relatively more imports.

In addition to looking at the gains from facilitating trade across both sides of trade flows and across countries, Table 3 explores an additional distributional effect related to firms’ size. By interacting trade facilitation variables with firms’ size, the models tell whether any gains as a result of facilitating trade vary between small and large firms. The results show that, while size per se appears to matter only for importing firms, it tends to affect the distribution of trade benefits across firms on either side of trade.

| Exports | Imports | |||

|---|---|---|---|---|

| Heckit: All | Heckit: SSA | Heckit: All | Heckit: SSA | |

| Regulation | − 0.2062*** (0.01) | − 0.3038*** (0.06) | − 0.2448*** (0.03) | − 0.5076*** (0.05) |

| Energy | − 2.2309*** (0.03) | − 2.7620*** (0.02) | − 1.0321*** (0.02) | − 1.1532*** (0.01) |

| Telecoms | 4.8573*** (0.34) | 10.9608*** (1.59) | 3.8749*** (1.38) | 3.4269*** (1.20) |

| Finance | 5.5484*** (0.45) | − 5.0425** (2.24) | 4.6961* (3.16) | 1.5741* (1.19) |

| Customs | − 0.2487*** (0.02) | − 0.5027*** (0.08) | − 0.0328* (0.04) | − 0.3966*** (0.03) |

| Regulation*size | 0.0001** (0.00) | 0.0003* (0.00) | 0.0001 (0.02) | 0.0002* (0.00) |

| Energy*size | 0.0203* (0.01) | 0.0181 (0.03) | − 0.1872* (0.12) | − 0.1006*** (0.02) |

| Telecoms*size | 0.0017*** (0.00) | − 0.0046* (0.00) | 0.0003 (0.02) | − 0.0326*** (0.01) |

| Finance*size | − 0.0004* (0.00) | 0.0052* (0.01) | 0.0017* (0.00) | 0.0175*** (0.01) |

| Customs*size | 0.0001* (0.00) | − 0.0003* (0.00) | 0.0001 (0.00) | 0.0005*** (0.00) |

| Size | 0.0014*** (0.00) | 0.0029* (0.00) | − 0.0006* (0.00) | 0.0318*** (0.01) |

| Age | − 0.0024* (0.00) | − 0.0046* (0.00) | 0.0264** (0.01) | 0.0230*** (0.01) |

| Informal | − 1.0853*** (0.29) | − 0.2749 (0.73) | − 1.8622** (0.84) | 0.4197 (0.81) |

| Foreign equity | − 0.9656*** (0.30) | − 2.3399*** (0.79) | − 2.9967*** (1.14) | 0.0442 (0.36) |

| Manager’s experience | 0.0064* (0.00) | − 0.0154* (0.01) | − 0.0929*** (0.03) | − 0.0189* (0.01) |

| Labor productivity | 0.0001*** (0.00) | 0.0001*** (0.00) | 0.0001** (0.00) | 0.0001*** (0.00) |

| ISO | 0.9287*** (0.31) | 0.7984* (0.69) | 2.1360** (1.00) | 0.2617* (0.38) |

| Capital city | − 0.3043*** (0.08) | 0.2489* (0.27) | − 0.9848*** (0.32) | − 0.5244** (0.30) |

| Intercept | 24.6742*** (1.09) | 32.9234*** (4.09) | 37.7055*** (7.09) | 7.3366*** (2.53) |

| N | 38,890 | 7432 | 37,168 | 7072 |

| Mills(lambda) | − 4.5656*** | − 6.6463*** | − 14.3930*** | − 3.4363*** |

| Wald | 1924*** | 391.9*** | 155.6*** | 592.3*** |

Notes: The dependent variables are the logarithm of firms’ exports and imports. Each regression includes country dummies. Values between parentheses are the standard errors, and significance at 1, 5, and 10% are indicated by ***, **, and *.

Estimation results with conditional marginal effects.

For developing countries as a whole, smaller firms tend to benefit the most from better regulations and efficient customs procedures in both export and import markets. Improving access to finance and the quality of the energy infrastructure generates greater gains for smaller firms on export markets and for larger firms on the import front. In addition, a greater usage of websites and e-mails to communicate with clients tends be more beneficial to larger firms.

As for SSA firms, and with respect to firms’ size, the distributional effect of the trade gains shows similar patterns when it comes to regulation and energy. But they are different for the remaining trade facilitation indicators. On both export and import markets, larger firms tend to reap greater benefits from a better functioning of the credit market, and their smaller counterparts from an improved usage of telecommunications. A reduction in customs clearance time benefits smaller firms the most on the export side and larger firms on the import side. In the end, the design of targeted trade facilitation measures may need to account for these distributional patterns.

Table A2 in the annexes shows the results from the first step Probit estimation in the selection models with modifying terms. Overall, as far as SSA firms are concerned, a greater rationalization of government regulations, and the resulting reduction in the management time dealing with the latter, increases the probability that firms enter into export and import markets, more so for import markets, and irrespective of size. A reduction in the incidence of power outages, as a result of an increased efficiency of the energy infrastructure, increases the likelihood that firms start exporting or importing, and smaller firms tend be more responsive than their larger counterparts. Furthermore, an increase in the usage of telecommunication tools is more likely to lead smaller firms to start exporting and larger firms to enter into imports. Finally, an improved access to finance is more important for smaller firms on import markets, so do efficient customs procedures on both import and export markets.

The results also suggest additional factors that affect firms’ decisions to start exporting or importing, as related to the control variables. Of particular interest is how the share of exporting firms and foreign capital in the industry may impact firms’ trade behavior. The estimation results point to some learning process among firms, as a given firm is more likely to start exporting or importing in industries with a larger share of existing trading firms or foreign-owned firms. This is very much in line with most of the literature on trade spillovers.

Overall, the results tend to establish once more that firms in SSA have a tendency to respond differently compared with their counterparts in the outside world. The responses vary greatly across trade facilitation measures and depending on which direction of cross-border trade one considers (export or import). Adding to the heterogeneity of the gains, there is a sizable distributional effect along the firm size dimension, and presumably other dimensions. This points to a political economy issue when governments across the sub-continent have to prioritize among the various trade facilitation measures, which are urgently needed to increase the presence and performance of SSA firms in the international trade arena.

6. Conclusion

This paper was concerned with empirically analyzing how trade facilitation initiatives would affect: (i) the probability that non-trading firms in developing countries, particularly those in sub-Saharan Africa, would start exporting and importing, and (ii) for already trading firms, how those initiatives could impact the extent to which they would actually trade. A broad range of trade facilitation indicators were considered, including: the quality of public regulations, energy and telecommunication infrastructure, trade finance, as well as customs clearance.

The results from models that control for self-selectivity into export and import markets, based on data from the World Bank’s Enterprise Surveys, suggest that firms in SSA are poised to reap greater benefits from trade facilitation initiatives than their average counterparts in the developing world. They also tend to respond more on the export side than on the import side, suggesting a positive adjustment of the balance of payments, at least in the short run.

However, the sizable distributional effect of the gains among firms of different sizes points to an internal dimension of the political economy challenge of trade facilitation reforms. In the end, the actual prioritization of the trade reforms may depend on the political balance of power among the various industrial segments, as well as on a full measurement of the implementation costs of these reforms that need to be compared with the expected trade gains. Such an exercise should reveal the true economic and social benefits of trade facilitation reforms in the sub-continent.

Acknowledgements

The author is grateful to an anonymous reviewer for his insightful comments.

Annexes

| Regul. | Ener. | Telec. | Finance | Cust. Ex. | Cust. Im. | |

|---|---|---|---|---|---|---|

| Regulation | 1.00 | |||||

| Energy | 0.21 | 1.00 | ||||

| Telecoms | − 0.32 | − 0.39 | 1.00 | |||

| Finance | − 0.34 | − 0.28 | 0.44 | 1.00 | ||

| Customs: exports | 0.10 | 0.13 | − 0.04 | 0.13 | 1.00 | |

| Customs: imports | 0.07 | 0.04 | − 0.27 | 0.04 | 0.69 | 1.00 |

Pair-wise correlation of the trade facilitation indicators.

Source: Author’s calculations, from World Bank’s Entreprise Surveys.

| Exports | Imports | |||

|---|---|---|---|---|

| All | SSA | All | SSA | |

| Regulation | 0.0089*** (0.01) | 0.0036 (0.01) | 0.0083*** (0.01) | − 0.0286*** (0.01) |

| Energy | − 0.0001*** (0.00) | − 0.0020*** (0.00) | 0.0001** (0.00) | − 0.0004** (0.00) |

| Telecoms | 0.1339** (0.06) | 0.4832*** (0.17) | − 0.3499*** (0.06) | 0.1292 (0.20) |

| Finance | 0.7316*** (0.06) | 0.5789** (0.26) | 1.1002*** (0.05) | − 0.1379 (0.22) |

| Customs | − 0.0251*** (0.00) | − 0.0095* (0.01) | 0.0132*** (0.00) | 0.0013 (0.00) |

| Regulation*size | 0.0132*** (0.00) | 0.0150 (0.00) | 0.0163 (0.00) | 0.0181 (0.00) |

| Energy*size | 0.0001*** (0.00) | − 0.0003** (0.00) | 0.0005*** (0.00) | − 0.0005* (0.00) |

| Telecoms*size | 0.0002** (0.00) | − 0.0007* (0.00) | 0.0016 (0.00) | 0.0056*** (0.00) |

| Finance*size | − 0.0003*** (0.00) | − 0.0006 (0.00) | − 0.0003*** (0.00) | − 0.0041*** (0.00) |

| Customs*size | 0.0000*** (0.00) | 0.0002*** (0.00) | 0.0000*** (0.00) | 0.0001*** (0.00) |

| Size | 0.0001*** (0.00) | 0.0006* (0.00) | 0.0002 (0.00) | − 0.0040*** (0.00) |

| Age | 0.0053*** (0.00) | 0.0049*** (0.00) | 0.0044*** (0.00) | 0.0009** (0.00) |

| Informal | 0.0955** (0.05) | − 0.0114 (0.10) | 0.1214** (0.05) | − 0.3406*** (0.12) |

| Foreign equity | 0.7008*** (0.02) | 0.5748*** (0.04) | 0.4075*** (0.02) | 0.2863*** (0.05) |

| Manager’s experience | 0.0031*** (0.00) | 0.0034** (0.00) | 0.0101*** (0.00) | 0.0127*** (0.00) |

| Labor productivity | 0.0001 (0.00) | 0.0002* (0.00) | 0.0001 (0.00) | 0.0001* (0.00) |

| ISO | 0.6855*** (0.02) | 0.4470*** (0.05) | 0.3507*** (0.02) | 0.2830*** (0.05) |

| Capital city | 0.0564*** (0.02) | 0.0708** (0.04) | 0.0830*** (0.01) | 0.2320*** (0.04) |

| Share of trading firms | 0.5356*** (0.06) | 0.5621*** (0.19) | 0.5405*** (0.04) | 0.4636*** (0.21) |

| Share of foreign-owned firms | 0.1072*** (0.01) | 0.8819*** (0.17) | 0.1014*** (0.01) | 0.8233*** (0.16) |

| Intercept | − 1.3945*** (0.04) | − 1.9356*** (0.13) | − 1.4444*** (0.05) | − 1.0430*** (0.22) |

Notes: The dependent variables take the value of 1 if the establishment exports or imports, 0 otherwise. Each regression includes country dummies. Additional statistics are shown in Table 3 above. Values between parentheses are the standard errors, and significance at 1, 5, and 10% are indicated by ***, **, and *.

Probit estimation results from the selection models with interaction terms.

| Variables | Definitions |

|---|---|

| Exports | Total value of firm’s export of own products (in logs) |

| Imports | Total value of firm’s imports of material inputs and supplies (in logs) |

| Export status | Dummy variable: 1 if firm exports, 0 otherwise |

| Import status | Dummy variable: 1 if firm imports, 0 otherwise |

| Regulation | Percentage of senior management time spent dealing with government regulations |

| Energy | Number of power outages experienced in a typical year |

| Telecoms | Dummy variable: 1 if firm either communicate with clients and suppliers by email or has its own websites, 0 otherwise |

| Finance | Dummy variable: 1 if firm has a line of credit or a loan from a financial institution, 0 otherwise |

| Customs | Average number of days for exported or imported goods to clear customs |

| Size | Number of workers |

| Age | Firm’s age (years) |

| Informal | Dummy variable: 1 if unregistered firm or unknown year of registration, 0 otherwise |

| Foreign equity | Dummy variable: 1 if at least 10% of firm is owned by foreign individuals, companies or organizations, 0 otherwise |

| Manager’s experience | Number of years the top manager has been working in the sector |

| Labor productivity | Value added (sales less costs of raw materials and intermediate goods, fuel and electricity) over number of workers |

| ISO | Dummy variable: 1 if the establishment has an internationally-recognized quality certificate, 0 otherwise |

| Capital city | Dummy variable: 1 if the establishment is located in the country’s capital city, 0 otherwise |

| Share of trading firms in the industry | Number of exporting/importing firms over the total number of firms in the industry (%) |

| Share of foreign firms in the industry | Number of foreign-owned firms (as defined above) over the total number of firms in the industry (%) |

Variables and definitions.

List of countries:

Albania, Angola, Argentina, Armenia, Bangladesh, Botswana, Bulgaria, Burundi, Central African Republic, Chile, China, Colombia, Costa Rica, Croatia, Czech Republic, Djibouti, Democratic Republic of Congo, Ecuador, Egypt, El Salvador, Estonia, Ethiopia, Georgia, Ghana, Guatemala, Honduras, Hungary, India, Indonesia, Jamaica, Jordan, Kazakhstan, Kenya, Kyrgyz Republic, Laos, Latvia, Lebanon, Lithuania, Macedonia, Madagascar, Malawi, Malaysia, Mauritania, Mexico, Moldova, Mongolia, Montenegro, Morocco, Namibia, Nicaragua, Nigeria, Pakistan, Papua New Guinea, Paraguay, Peru, Philippines, Poland, Romania, Rwanda, Senegal, Serbia, Slovak Republic, Slovenia, Sri Lanka, Sudan, Tajikistan, Tanzania, Thailand, Tunisia, Turkey, Uganda, Ukraine, Uruguay, Uzbekistan, Vietnam, Yemen, Zambia, and Zimbabwe.

Footnotes

Peer review under responsibility of Afreximbank.

Source: Author’s calculations from the 2016 World Bank’s Doing Business data. Quotes are from the annual report.

Source: WTO, at www.wto.org/tradefacilitation (accessed on 25 August, 2016).

Evidence suggests however that the benefits of trade facilitation implementation far outweigh the costs, at least beyond the short term. For instance, when it was half-way through, a five-year customs modernization program in Angola was estimated to have contributed to increase revenue by 150% and cut customs procedures by 24 h (OECD, 2005).

Also acknowledged in this cross-sectional setting is endogeneity. But we believe that it may not alter the results appreciably, as trade facilitation is likely to be generally out of the control of an individual firm (see, for instance, Secchi et al. (2016) and Minetti and Zhu (2011)).

Countries included in the sample are listed in the annexes.

References

Cite this article

TY - JOUR AU - Abdoulaye Seck PY - 2017 DA - 2017/07/08 TI - Trade facilitation and trade participation: Are sub-Saharan African firms different?☆ JO - Journal of African Trade SP - 23 EP - 39 VL - 3 IS - 1-2 SN - 2214-8523 UR - https://doi.org/10.1016/j.joat.2017.05.002 DO - 10.1016/j.joat.2017.05.002 ID - Seck2017 ER -